You’re Not Ready for the Economic Hit Coming in 2025

Hello~ Everyone! Today I'm talking about the economic challenges we might face in 2025. I have some useful information for you guys~ Shall we find out right away?

Many economists and financial experts are warning that 2025 could bring significant economic challenges that most people aren't prepared for. Whether you're an investor, business owner, or just trying to manage your personal finances, understanding what might be coming is essential.

Let's explore what might happen and how you can protect yourself and your assets during these uncertain times.

| Warning Signs | Vulnerable Sectors |

| Rising interest rates Inflation concerns Supply chain disruptions Global tensions |

Real estate market Tech industry Retail businesses Emerging markets |

| Stock market volatility Bond market challenges Reduced consumer spending Energy price fluctuations |

Tourism Manufacturing Small businesses Luxury goods |

🔮 Economic Indicators Flashing Red

Several economic indicators are currently showing concerning trends that suggest trouble ahead. The combination of persistent inflation and rising interest rates is creating a perfect storm for many sectors.

The Federal Reserve's policies have led to higher borrowing costs, which is putting pressure on businesses and consumers alike. This could lead to a significant slowdown in economic activity by mid-2025.

Recent data shows consumer confidence is starting to waver, with spending patterns showing signs of restraint. This is particularly concerning because consumer spending drives approximately 70% of economic activity in the United States.

When people stop buying, businesses stop growing. It's that simple. 😟

💼 Job Market Transformation

The job market is likely to undergo significant changes in 2025. While unemployment rates have been relatively low, many economists predict a shift as companies look to cut costs in response to economic pressures.

Remote work trends established during the pandemic will face new challenges as companies reassess their workforce needs. Some industries may see substantial layoffs while others struggle to find qualified workers.

Automation and AI implementation are accelerating, potentially eliminating certain job categories faster than new ones can be created. This technological shift won't wait for economic recovery.

Is your career recession-proof? This is a question more people should be asking themselves right now. 🤔

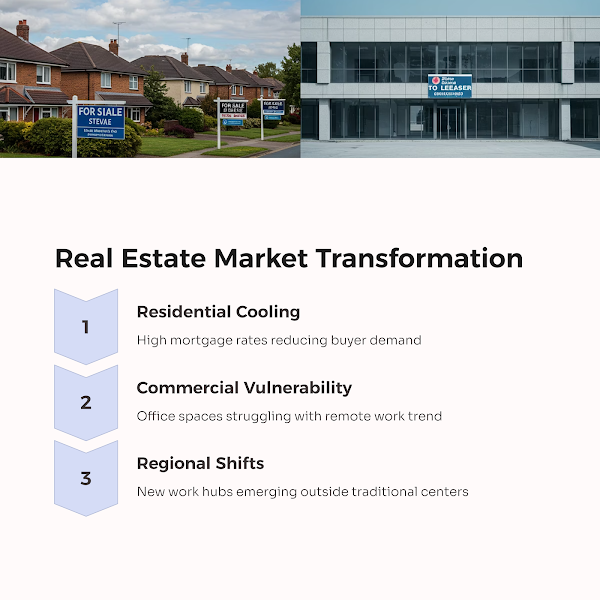

🏠 Real Estate Reality Check

The real estate market, which has been on a roller coaster since 2020, may face its biggest test yet in 2025. Higher mortgage rates are already cooling demand in many markets, and this trend is likely to accelerate.

Commercial real estate is particularly vulnerable as work-from-home policies become permanent for many companies. Office buildings in major cities are seeing unprecedented vacancy rates.

Those who purchased homes at peak prices with adjustable-rate mortgages may find themselves underwater as property values adjust to new market realities.

Location matters more than ever, with some regions likely to be hit much harder than others. 🏢

💰 Investment Strategy Shifts

Traditional investment approaches may not work in the economic environment of 2025. The "60/40" portfolio split between stocks and bonds has already shown weaknesses in recent years.

Diversification takes on new importance, with alternative investments potentially offering better protection against inflation and market volatility.

Cash, long considered a poor asset during inflationary periods, may provide strategic advantages for opportunistic investors as asset prices decline.

The key is flexibility and avoiding the trap of following outdated investment wisdom that doesn't apply to current conditions. 📈

🛡️ Building Personal Financial Resilience

Personal financial preparation will separate those who merely survive the economic challenges of 2025 from those who might actually thrive during this period.

Emergency funds become even more crucial, with experts now suggesting 6-12 months of expenses saved rather than the traditional 3-6 months.

Reducing debt, particularly high-interest debt, should be a priority before economic conditions worsen. The cost of carrying debt could increase significantly as interest rates rise.

Multiple income streams provide essential protection against job loss or business downturns. Side hustles aren't just for extra spending money anymore—they're financial insurance. 💪

| Economic Factors | Financial Strategies | Global Implications |

| Inflation | Diversification | Supply Chains |

| Interest Rates | Debt Reduction | Currency Fluctuations |

| Market Volatility | Emergency Fund | Geopolitical Tensions |

| Unemployment | Skill Development | Energy Markets |

The coming economic challenges won't affect everyone equally. Those who recognize the warning signs and take proactive steps will be in a much better position to weather the storm and possibly even find opportunities amid the difficulties.

Remember that economic cycles are natural, and downturns eventually lead to recoveries. The question isn't whether challenges are coming, but how prepared you'll be when they arrive. 🔄

Taking small, consistent actions now can make a tremendous difference in your financial situation when the economy faces its biggest tests in 2025.

❓ Common Questions About the 2025 Economic Outlook

| How long might an economic downturn in 2025 last? | While it's impossible to predict with certainty, historical patterns suggest that significant economic adjustments typically last 12-24 months. However, the recovery phase can vary widely depending on policy responses and global conditions. |

| Which investments might perform better during economic uncertainty? | Traditionally, consumer staples, utilities, healthcare, and certain commodity investments have shown more resilience during economic downturns. Digital assets and precious metals might also serve as hedges, though with their own volatility risks. |

| Is it better to pay down debt or build savings before a potential downturn? | Ideally, you should do both, but if you must prioritize, focus first on high-interest debt while maintaining at least a small emergency fund. Once high-interest debt is eliminated, shift more resources toward building robust cash reserves. |

The economic landscape is constantly evolving, and staying informed is your best defense against uncertainty. Keep learning, stay flexible in your planning, and remember that financial resilience is built through consistent, thoughtful actions over time.

While challenges lie ahead, those who approach them with preparation and the right mindset will find themselves not just surviving but potentially thriving in the new economic reality that emerges. 🌟

See you next time with a better topic 👋 Bye Bye~

Comments

Post a Comment