The Real Reason You’ll Miss the Next Bull Run

Hello~ Everyone, this is Momo 😊 Today is about cryptocurrency bull runs and why people miss them! I have some useful information for you guys~ Shall we find out right away?^^

Have you ever watched crypto prices skyrocket while sitting on the sidelines?

That feeling of missing out can be devastating, especially when you see others celebrating their gains.

But don't worry - understanding why people miss bull runs is the first step to making sure you don't repeat the same mistakes!

The crypto market moves in cycles, and many investors struggle to recognize the early signs of a bull run.

Fear and hesitation often cause people to wait too long before entering the market, missing the most profitable period.

| Common Mistakes | Psychological Barriers |

| Waiting for "confirmation" | Fear of losing money |

| Overanalyzing market signals | Previous bad experiences |

| Following the crowd | Analysis paralysis |

| Trying to time the perfect entry | Regret aversion |

It's fascinating how our brains work against us when it comes to investing.

We tend to be more afraid of losses than excited about potential gains - a concept known as loss aversion.

When markets are down, we feel anxious about investing. When markets start rising, we wait for a pullback that may never come.

This psychological trap is difficult to escape and is often the real reason why most people miss bull runs.

Learning to spot the early signs of a bull market can give you a significant advantage.

Increased trading volume, positive regulatory news, and institutional adoption are all potential indicators.

However, these signals are often subtle and easily missed if you're not paying close attention.

The key is developing a systematic approach to market analysis rather than relying on emotions or social media hype.

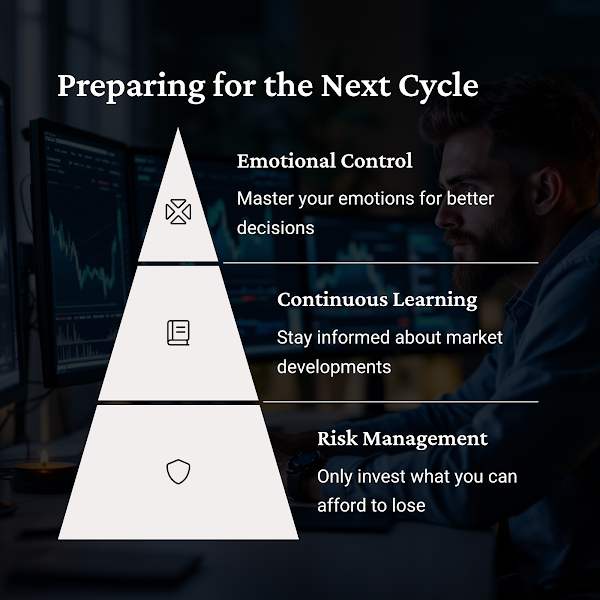

Having a clear strategy before a bull run begins is essential for success.

This includes setting entry and exit points, determining position sizes, and establishing risk management rules.

Without a strategy, you'll likely make impulsive decisions based on FOMO or panic when volatility increases.

Remember that preparation is what separates successful investors from those who consistently miss opportunities.

Instead of trying to predict exactly when the next bull run will happen, focus on being ready when it does.

This means continuous education, building cash reserves during bear markets, and maintaining emotional discipline.

The most successful crypto investors are those who use downturns to strengthen their knowledge and position, not those who try to time markets perfectly.

| Market Phase | Key Actions | Mindset |

| Early Bear Market | Reduce exposure, preserve capital | Patience, research |

| Deep Bear Market | Build watchlists, study fundamentals | Curiosity, preparation |

| Early Bull Signs | Begin calculated entry, diversify | Cautious optimism |

| Bull Market | Implement taking-profit strategy | Discipline, emotional control |

Did you know that most investors actually underperform the assets they invest in? This happens because they buy high and sell low, driven by emotions rather than strategy.

Understanding market psychology isn't just helpful - it's essential for capturing gains during bull runs.

The most successful investors don't just pick good assets; they master their own emotional responses to market movements.

| Key Concept | Application | Benefit |

| Dollar-Cost Averaging | Regular investments regardless of price | Removes timing pressure |

| Position Sizing | Allocating appropriate capital per asset | Manages risk exposure |

| Profit-Taking Plan | Predetermined exit points | Prevents emotional decisions |

| Market Sentiment Analysis | Tracking fear and greed indicators | Identifies potential turning points |

How long do crypto bull runs typically last?

Crypto bull runs have historically lasted between 12-18 months, but each cycle has unique characteristics and timeframes. The key is to focus on market fundamentals rather than specific time predictions.

Is it too late to invest when everyone is talking about crypto?

When crypto becomes mainstream news, we're often in the later stages of a bull run. However, even late-stage bull markets can offer opportunities if you're selective about projects and have clear exit strategies.

What's the biggest indicator that a bull run is starting?

Rather than looking for a single indicator, focus on convergence of multiple factors: increasing trading volumes, positive developer activity, institutional adoption announcements, and improving market sentiment after prolonged bearish periods.

Remember that success in crypto investing isn't about making perfect decisions - it's about making good decisions consistently over time. 😊

See you next time with a better topic 👋 Bye Bye~

Comments

Post a Comment